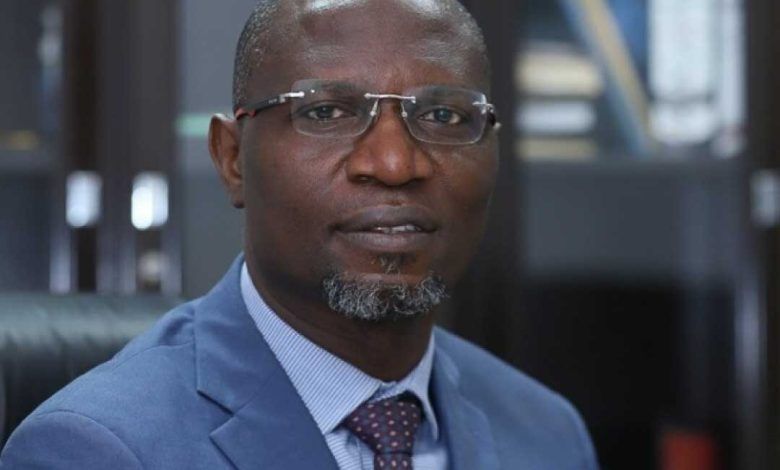

The Director-General of the Securities and Exchange Commission (SEC), Nigeria, Emomotimi Agama, has called for the urgent mobilisation of African capital markets to address the continent’s massive climate adaptation financing shortfall, estimated at up to $100 billion annually by 2030.

Speaking during a high-level panel on “The Role of Capital Markets in Closing Financing Gaps for Climate Adaptation” at the African Development Bank (AfDB) Annual Meetings, Agama stressed that tackling the climate crisis must move from ambition to execution and capital markets must play a central role.

“Closing the climate adaptation financing gap in Africa is not a distant aspiration but a development imperative one that demands our collective ingenuity and capital,” Agama said.

Africa’s Climate Finance Crisis

Despite contributing less than 4% to global greenhouse gas emissions, Africa suffers over 25% of global climate-related losses, Agama noted. He warned that without swift action, the climate crisis will continue to erode livelihoods across the continent, from drought in the Sahel to coastal flooding in Lagos and Nairobi.

“These figures are not just statistics. They represent vanishing livelihoods, rising insecurity, and intensifying climate shocks,” he added.

According to the 2022 Africa Economic Outlook, Africa requires $500 billion in climate finance by 2030. The UNEP’s 2023 Adaptation Gap Report further estimates that developing countries, including those in Africa, need between $212 billion and $387 billion annually for climate adaptation alone. Yet, current flows fall drastically short — up to 50 times below required levels.

Mobilising Capital Through Market Innovation

Agama outlined a three-pronged strategy to unlock adaptation finance:

- Regional Capital Market Integration

- Harmonisation of ESG and climate risk standards

- Adoption of the ISSB Sustainability Disclosure Framework

“The ISSB standards are a game-changer. They will standardise sustainability reporting, eliminate greenwashing, and unlock institutional capital for climate adaptation,” he stated.

He highlighted Nigeria’s sovereign green bond success story as a blueprint. Launched in 2017 the first in sub-Saharan Africa the bond was oversubscribed 2.5 times, thanks to strong demand from local pension funds and diaspora investors seeking impact-driven returns.

“That bond proved what’s possible when the right instruments and confidence-building frameworks are in place,” Agama said.

Nigeria’s Leadership in Sustainability Standards

Agama also spotlighted Nigeria’s leadership in driving ESG adoption, noting that the SEC represents the country on the International Sustainability Standards Board’s Adoption Readiness Working Group (ARWG), which is spearheading the rollout of the IFRS S1 and S2 Sustainability Disclosure Standards.

Under the ARWG roadmap:

- Early Adoption: Begins January 1, 2024

- Voluntary Adoption: January 2024 – December 2026

- Mandatory Adoption: Starts January 1, 2027 (for all entities except government bodies)

“This positions Nigeria at the forefront of transparent and comparable sustainability reporting across Africa,” Agama said.

Tackling Key Barriers to Adaptation Finance

Agama identified three major challenges stifling adaptation finance:

- Perception risks

- Data and measurement gaps

- Private sector risk aversion

He urged the use of credit enhancements, blended finance tools, and robust project pipelines to de-risk early-stage investments and attract institutional capital.

“This is where our capital markets must step in. Regulators, investors, standard-setters, and governments must act in unison,” he declared.

A Continental Call to Action

Concluding his address, Agama called on African leaders and development partners to seize the moment and forge a unified path toward climate resilience through capital markets.

“Let us deepen African capital markets and finance the resilience of our continent and our people. The recent journey in Nigeria proves that it can be done.”