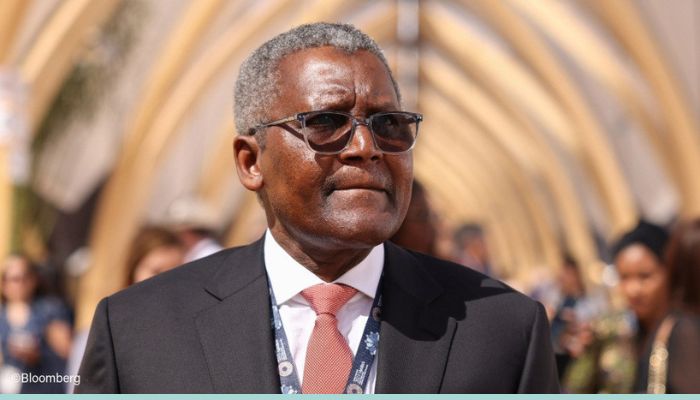

Africa’s richest man and President of Dangote Group, Aliko Dangote, says he remains unfazed by the recent U.S. tariffs on Nigerian exports, pointing to a surprising upside for his company’s urea shipments.

Speaking at an investment conference in Lagos on Thursday, Dangote addressed concerns over the 14% tariff imposed by former U.S. President Donald Trump on Nigerian imports last month a decision that briefly rattled several sectors before being temporarily suspended for 90 days.

While the announcement initially caused anxiety, Dangote said his concerns were quickly tempered by the realization that Algeria, a key competitor in the urea market, had been hit with an even steeper 30% tariff.

“I was a bit worried when the tariffs were announced,” Dangote admitted. “But when I checked who we are really competing with, we are competing with Algeria. So luckily for us, Algeria was slapped with 30 per cent. That actually makes us a bit comfortable.”

Dangote Fertiliser, which began full-scale operations in 2022, currently produces around 3 million metric tonnes of urea annually. According to Dangote, 37% of that output is exported to the United States, making the U.S. a significant market for the company’s fertiliser business.

The billionaire industrialist also shared optimistic projections about the Dangote Group’s future growth, revealing that the company’s total valuation is expected to rise to over $30 billion by 2026, up from a projected $25 billion in 2025.

In addition to fertiliser, the Dangote Group is a dominant player in cement and recently commissioned Africa’s largest petroleum refinery, further solidifying its role as a critical pillar of Nigeria’s industrial economy.

Dangote’s comments follow a string of strategic initiatives from the group, including a plan to convert 6,000 diesel trucks in its fleet to compressed natural gas (CNG) in line with cleaner energy goals.

As diplomatic discussions continue around U.S. trade policy, the temporary reprieve from tariffs provides breathing space for Nigerian exporters. Meanwhile, Dangote Group’s diversified strategy and competitive positioning seem poised to not only weather the storm but potentially benefit from it.