Kenya Unveils Budget Amid Pressure to Balance Debt and Social Stability

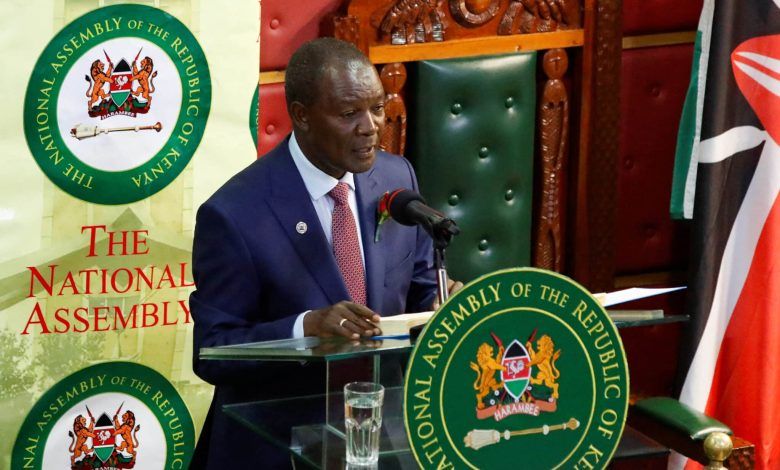

Kenya’s Finance Minister is set to present a new budget on Thursday aimed at bolstering government revenues to service the country’s mounting debt—while carefully avoiding the tax hikes that sparked widespread and deadly protests last year.

The East African nation, led by President William Ruto, faces the twin challenges of narrowing a persistent fiscal deficit and managing a hefty debt-to-GDP ratio approaching two-thirds—well above the 55% threshold considered sustainable by economists.

Last year’s nationwide demonstrations forced the government to abandon planned tax increases totaling over 346 billion Kenyan shillings ($2.7 billion) and implement austerity measures to calm public unrest. This year, Finance Minister John Mbadi vowed a different approach.

“Kenyans cannot bear more tax,” Mbadi stated firmly on Wednesday. “For the first time, the current finance bill does not include new taxes, unlike previous years.”

However, critics argue that the government is circumventing direct tax hikes by expanding indirect taxes and enhancing the Kenya Revenue Authority’s powers to monitor bank accounts and mobile money transactions—raising concerns over privacy and government overreach.

Mbadi defended the move, saying the tax authority must be empowered to improve revenue collection necessary for running the country.

Rather than increasing taxes, the budget focuses on broadening the tax base, improving compliance, and cutting government spending, experts say.

“They recognize the public’s dissatisfaction, particularly with how tax revenues are utilized,” explained John Kuria, tax specialist and partner at Kody Africa. Still, he cautioned that despite efforts to clamp down on fraud and tighten expenditure, Kenya is likely to face a significant funding gap.

Shani Smit-Lengton, Senior Economist at Oxford Economics Africa, pointed out that while the budget’s deficit reduction measures are credible on paper, Kenya’s historical challenges with implementation often result in mid-year budget revisions. Such adjustments risk undermining fiscal credibility.

Earlier this year, Kenya applied for a new lending program from the International Monetary Fund (IMF) after halting the final review of its previous arrangement.

Additionally, Kenya has joined a growing list of African nations borrowing on international markets to refinance maturing debts and protect vital sectors like health from budget cuts.

“The stakes are high,” Smit-Lengton noted. “The government must demonstrate stronger fiscal discipline to secure a new IMF program while managing public sentiment to avoid further social unrest.”

Achieving this delicate balance is crucial to maintaining investor confidence and domestic stability. Yet, she warned the government’s goal to shrink the fiscal deficit to 4.5% in the coming financial year may be overly ambitious.