Africa’s richest industrialist says government reforms and reduced import dependence could drive major currency gains, but warns Nigeria must fix power and protect local manufacturers to sustain momentum…

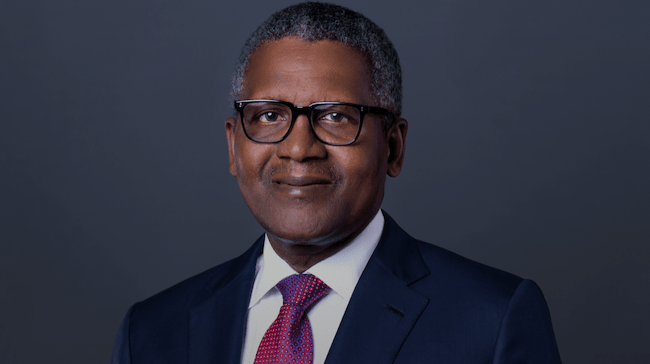

The Chairman of the Dangote Group, Aliko Dangote, has projected a significant rebound for the naira, expressing confidence that the currency could strengthen to as much as ₦1,000 to the dollar before the end of the year.

Dangote made the remarks on Tuesday in Abuja during the launch of the Nigeria Industrial Policy, an event attended by Vice President Kashim Shettima, senior government officials, and key private sector players.

With the naira currently trading around ₦1,300 to ₦1,340 against the dollar, Dangote said ongoing reforms introduced by the federal government are beginning to yield results particularly for manufacturers.

“People are already seeing the impact of these policies,” he said. “Manufacturers are very happy.”

Why Dangote Is Bullish on the Naira

According to him, a clampdown on excessive importation and a renewed push for domestic production could sharply reduce demand for foreign exchange, strengthening the local currency.

He suggested the naira could climb to around ₦1,100 to the dollar and potentially even ₦1,000, if current reforms are sustained.

However, Dangote described the situation as a “catch-22.” While a stronger naira would reduce the cost of imported goods and potentially ease inflationary pressures, Nigeria’s heavy dependence on imports exposes structural weaknesses in the economy.

“If the naira gets stronger, prices will drop because we are import-based which we shouldn’t be,” he noted. “What we should be doing is manufacturing what we consume.”

Protection and Power: The Missing Links

Beyond currency gains, Dangote stressed that industrial growth requires more than policy announcements. He called for stronger protection of local investors and meaningful improvements in infrastructure, especially electricity supply which he described as a persistent obstacle to doing business in Nigeria.

He argued that without stable power and clear incentives, industrialists will struggle to drive the job creation and economic expansion envisioned in the new policy framework.

Otedola Shares Similar Outlook

Dangote is not alone in his optimism. Just last week, Femi Otedola, Chairman of First HoldCo, also projected that the naira could strengthen to ₦1,000 per dollar before year-end. He attributed his forecast to increased domestic refining capacity, which is expected to reduce Nigeria’s dependence on imported petroleum products and ease pressure on foreign exchange reserves.

Private Sector as the Engine of Growth

At the event, Vice President Shettima underscored the critical role of private enterprise in delivering Nigeria’s industrial ambitions. He revealed that Dangote Cement alone contributed ₦900 billion in taxes in 2025, describing it as evidence of how large-scale local investment can significantly boost government revenue.

The Nigeria Industrial Policy is designed to accelerate value addition, deepen industrial linkages, enhance export competitiveness, and stimulate sustainable job creation.

A Turning Point or Another Projection?

While projections of a stronger naira have surfaced before, the alignment of voices from major industrial players adds weight to the current optimism. The big question remains whether reforms, infrastructure upgrades, and industrial protection measures can be implemented consistently enough to translate forecasts into reality.

For now, the message from Nigeria’s top business leaders is clear: if the country produces more of what it consumes and protects those who invest locally, the naira’s recovery may not just be possible, but inevitable.