In a groundbreaking move aimed at improving financial inclusion, the Central Bank of Nigeria (CBN), in partnership with the Nigeria Inter-Bank Settlement System (NIBSS), has launched the Non-Resident Bank Verification Number (NRBVN) platform. This digital innovation, unveiled in Abuja on Tuesday, now allows Nigerians living abroad to obtain their BVN remotely, eliminating the longstanding requirement for physical presence in Nigeria.

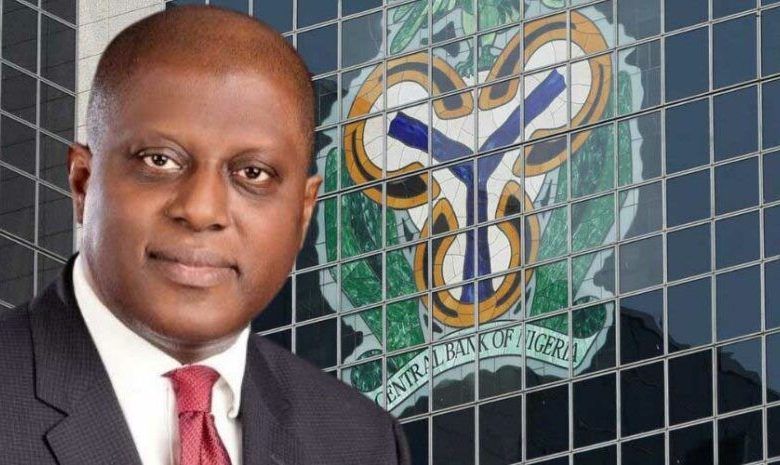

During the launch, CBN Governor Olayemi Cardoso hailed the NRBVN platform as a major step forward in the bank’s efforts to improve financial inclusion, particularly for the Nigerian diaspora. “For years, many Nigerians abroad have struggled to access essential financial services back home due to the physical verification process,” Cardoso noted. “The NRBVN platform changes that by offering a secure, digital alternative that allows for seamless verification, making financial services more accessible and affordable for Nigerians globally.”

Cardoso emphasized that the introduction of the NRBVN platform would not only simplify access to financial services but would also foster innovation and build greater trust in Nigeria’s financial system. He outlined the CBN’s vision of creating a more secure, efficient, and inclusive financial ecosystem that serves Nigerians worldwide.

Beyond the convenience of remote verification, the NRBVN platform is positioned to boost Nigeria’s growing remittance inflows. Cardoso pointed out that Nigeria saw a remarkable rise in remittance inflows, from $3.3 billion in 2023 to $4.73 billion in 2024, spurred by recent foreign exchange reforms. He expressed optimism that with the NRBVN and other complementary policies, Nigeria could achieve its ambitious goal of $1 billion in monthly remittances.

The platform also adheres to global standards for Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, ensuring security and transparency. Premier Oiwoh, the Managing Director and CEO of NIBSS, offered a technical overview of the platform, highlighting its user-friendly design and robust security features, which are aligned with international regulatory standards.

Muhammad Abdullahi, Deputy Governor for Economic Policy at the CBN, described the NRBVN as a “transformational tool” that will strengthen the bond between Nigeria and its global citizens. “We are on the cusp of a new era, one that will deepen trust, spur remittance growth, and strengthen the ties between Nigeria and its diaspora,” Abdullahi said.

The NRBVN platform is part of a broader initiative designed to support Nigerians abroad with access to a variety of financial products. These include the non-resident ordinary account and non-resident Nigerian investment account, providing a full spectrum of services such as savings, mortgages, pensions, insurance, and investment opportunities within Nigeria’s financial ecosystem.

Through this initiative, the CBN aims to enhance the economic integration of Nigerians abroad, positioning the country as a leader in financial inclusion within the global community.