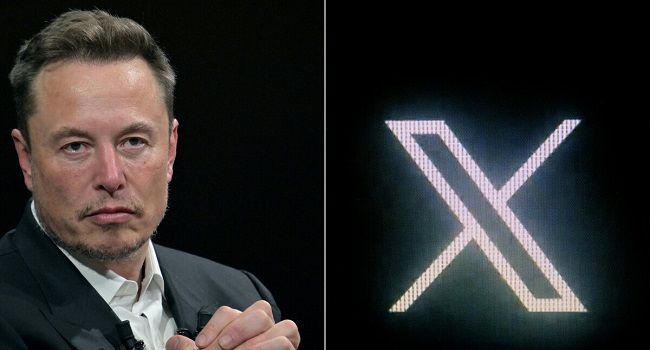

Elon Musk’s social media platform, X (formerly Twitter), has raised nearly $1 billion in new equity funding from investors.

According to a Bloomberg report, citing sources familiar with the deal, the funding round values the company’s equity at approximately $32 billion, aligning with the valuation when Musk acquired the platform in 2022.

The report also noted that the buyout included at least $12.5 billion in debt, meaning the latest fundraising was completed at an enterprise value of around $44 billion, the same as Musk’s initial purchase price.

Musk himself participated in the equity raise, alongside other investors, including Darsana Capital Partners, which had previously purchased some of X’s debt earlier this year. 1789 Capital, an investment firm backing Musk’s ventures such as xAI and SpaceX, also contributed to the funding round.

Musk has often turned to private markets to secure funding for his various ventures. Recently, SpaceX completed a tender offer valuing the company at about $350 billion, and xAI is reportedly seeking fresh funding at a $75 billion valuation.

Since Musk took ownership of Twitter in 2022 and rebranded it as X, the platform has undergone significant changes, including deep workforce cuts and a large-scale exodus of advertisers.

Many marketers paused or withdrew their ad spending due to concerns about their advertisements appearing alongside inappropriate content. In response, Musk has taken legal action to encourage advertisers to return, with X currently suing several major brands for withholding advertising spending, alleging anti-competitive behavior.

While some advertisers have resumed spending, industry insiders suggest that Musk’s legal threats and his prominent role in the political sphere may be influencing their decisions.